Revenue Based Financing for SaaS Startups: Pros and Cons sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In this discussion, we will delve into the world of Revenue-Based Financing (RBF) for SaaS startups, exploring its benefits and drawbacks in a comprehensive manner.

Introduction to Revenue-Based Financing for SaaS Startups

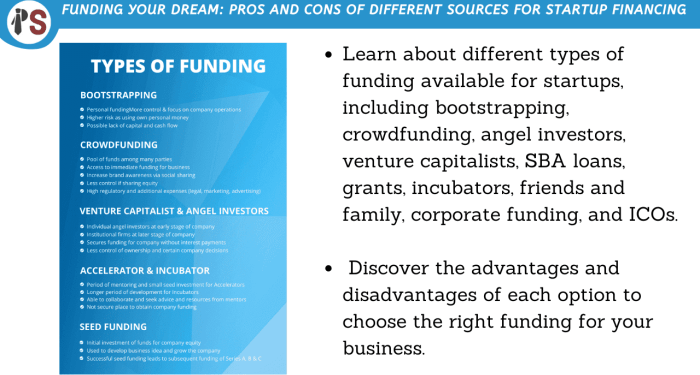

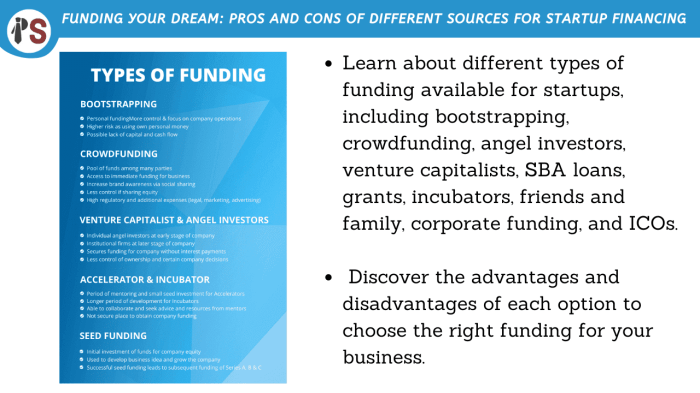

Revenue-Based Financing (RBF) is a funding model specifically designed for Software as a Service (SaaS) startups. Unlike traditional equity financing, RBF provides capital to startups in exchange for a percentage of future revenues.

How RBF Works for SaaS Companies

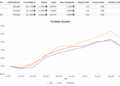

RBF works by providing upfront capital to SaaS startups, which is then repaid based on a percentage of monthly revenues. This repayment continues until a predetermined revenue multiple is reached, typically ranging from 1.5x to 3x the original investment amount.

Key Characteristics of RBF for SaaS Startups

- RBF is non-dilutive: Unlike equity financing, RBF does not require giving up ownership or control of the company.

- Flexible Repayment: Repayments are tied to revenue, so startups pay more during high-revenue months and less during low-revenue periods.

- Quick Access to Capital: SaaS startups can access capital quickly without the lengthy process of traditional funding rounds.

- Alignment of Interests: RBF investors are aligned with the success of the startup, as they benefit from revenue growth.

Pros of Revenue-Based Financing for SaaS Startups

Revenue-Based Financing (RBF) offers several advantages for SaaS startups compared to traditional funding methods. One of the key benefits is the alignment of interests between the investor and the startup, as the repayment is directly tied to the revenue generated by the business.

This results in a more flexible and entrepreneur-friendly financing option.

Increased Control and Flexibility

RBF allows SaaS startups to maintain control over their operations and decision-making processes. Unlike traditional equity financing, where investors often require a stake in the company and a say in its direction, RBF investors do not take equity. This enables startups to scale their operations and make strategic decisions without diluting ownership or giving up control.

Steady Cash Flow

Since repayments are based on a percentage of revenue, RBF provides startups with a predictable and manageable repayment structure. This can be especially beneficial for SaaS companies with recurring revenue streams, as they can align their repayments with their cash flow, making it easier to plan and budget for the future.

Support for Growth

RBF can be a valuable tool for SaaS startups looking to accelerate their growth without taking on additional debt or giving up equity. By providing access to capital based on existing revenue, startups can invest in product development, marketing, and sales initiatives to scale their business more quickly and efficiently.

Successful Examples

Several successful SaaS companies have benefited from Revenue-Based Financing, including companies like Buffer and Baremetrics. These companies were able to leverage RBF to fuel their growth while retaining control over their businesses. This demonstrates the effectiveness of RBF as a funding option for SaaS startups seeking to achieve rapid and sustainable growth.

Cons of Revenue-Based Financing for SaaS Startups

Revenue-Based Financing (RBF) can be a beneficial financing option for SaaS startups, but it also comes with its own set of challenges and limitations. Let's explore some of the drawbacks associated with RBF for SaaS companies.

1. Lack of Ownership Stake

One of the main drawbacks of RBF is that it does not provide the investor with an ownership stake in the company. This means that the startup founders retain full ownership and control over the business, but it also means that they miss out on the strategic guidance and network that traditional equity investors can provide

2. High Cost of Capital

RBF can be more expensive than traditional debt financing or equity funding. Since the repayments are tied to a percentage of the company's revenue, the effective interest rate can be significantly higher than what a company would pay for a traditional loan.

3. Revenue Volatility Risk

Since the repayments under RBF are based on the company's revenue, there is a risk of higher repayments during periods of high revenue and lower repayments during periods of low revenue. This can put strain on the company's cash flow and make it challenging to manage finances effectively.

4. Limited Scalability

RBF is typically structured with a cap on the total amount that can be repaid to the investor. This can limit the scalability of the business, as the company may reach a point where it is unable to access additional financing through RBF to fuel further growth.

Key Considerations for SaaS Startups Evaluating Revenue-Based Financing

When considering Revenue-Based Financing (RBF) as a funding option, SaaS startups need to carefully evaluate various factors to determine if it aligns with their growth plans and long-term financial health.

Impact on Revenue Growth

- RBF can provide immediate capital without giving up equity, allowing SaaS startups to invest in sales and marketing efforts to accelerate revenue growth.

- However, the revenue share percentage agreed upon in the RBF arrangement can impact profitability and cash flow in the long run, so startups must assess the trade-off between short-term growth and long-term sustainability.

Flexibility in Repayment

- Unlike traditional loans, RBF repayment is tied to revenue, meaning startups only repay when they generate revenue. This can provide flexibility during periods of low sales but may result in higher overall repayment amounts if the SaaS business experiences rapid growth.

- Startups should consider their revenue projections and growth trajectory to determine if the repayment terms of RBF align with their financial expectations.

Impact on Ownership and Control

- RBF does not require startups to give up equity, allowing founders to retain ownership and control over decision-making processes.

- However, the revenue share model in RBF means that investors have a claim on a percentage of future revenues, which can impact the autonomy of the startup in allocating resources and planning for the future.

Long-Term Financial Health

- While RBF can provide a non-dilutive funding option for SaaS startups, the continuous revenue sharing can reduce the overall profitability of the business over time.

- Startups need to evaluate the impact of RBF on their financial health and sustainability, considering factors like margin erosion, cash flow implications, and the ability to scale operations effectively.

Summary

In conclusion, Revenue-Based Financing emerges as a viable option for SaaS startups, providing a unique approach to funding that balances control and growth potential.

FAQ Insights

What are the key characteristics of Revenue-Based Financing for SaaS startups?

RBF offers SaaS startups a flexible funding model based on their revenue, allowing them to scale operations without giving up equity.

How does RBF help SaaS startups maintain control over their operations?

Unlike traditional funding, RBF allows startups to repay investors based on revenue, providing more control and flexibility in managing their growth.

What are the potential risks associated with opting for RBF as a financing strategy?

While RBF offers benefits, it also comes with risks such as higher repayment amounts during successful periods and potential constraints on future financing options.