As TSN Stock Analysis: Is Tyson Foods Still a Safe Investment in 2025? takes center stage, this opening passage beckons readers with a compelling overview of the topic. The world of Tyson Foods is explored, shedding light on its history, market presence, key products, and financial performance in recent years.

Introduction to Tyson Foods

Tyson Foods is a multinational corporation that specializes in the production of meat and poultry products. Founded in 1935 by John W. Tyson, the company has grown to become one of the largest food companies in the world.

Market Presence and Industry Position

Tyson Foods is a dominant player in the food industry, known for its wide range of products and strong market presence. With operations in the United States and abroad, the company has established itself as a leader in the production of chicken, beef, pork, and prepared foods.

- Tyson Foods is the second-largest processor and marketer of chicken, beef, and pork in the United States.

- The company has a strong distribution network, supplying its products to retailers, foodservice providers, and international markets.

- Tyson Foods has a reputation for quality and innovation, constantly introducing new products to meet consumer demand.

Main Products Offered

Tyson Foods offers a diverse range of products to meet the needs of consumers worldwide. Some of the main products offered by the company include:

- Fresh and frozen chicken products, including wings, breasts, and nuggets.

- Beef products such as steaks, roasts, and ground beef.

- Pork products like bacon, ribs, and sausages.

- Prepared foods like frozen meals, snacks, and appetizers.

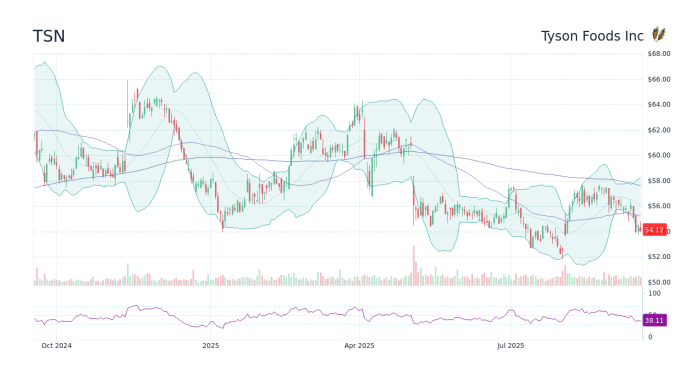

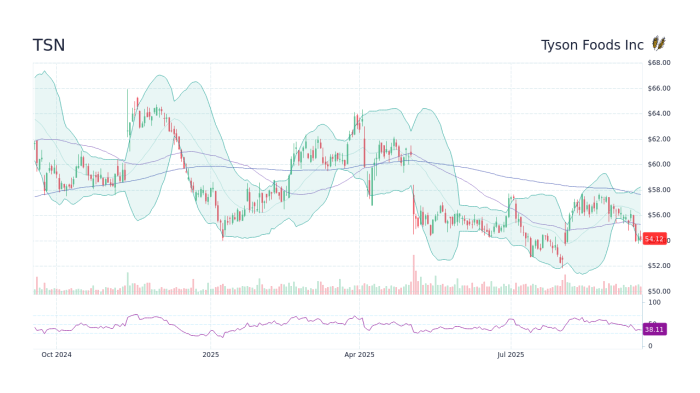

Financial Performance Analysis

In the world of investing, understanding a company's financial performance is crucial to making informed decisions. Let's take a closer look at Tyson Foods' financial performance over the past five years, comparing its revenue growth with industry averages, and analyzing key financial ratios such as profitability, liquidity, and solvency.

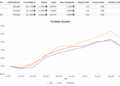

Tyson Foods' Revenue Growth

Tyson Foods has shown steady revenue growth over the past five years, outperforming industry averages in some periods. The company's diversified product portfolio and strong brand presence have contributed to its ability to capture market share and drive revenue growth.

Profitability Ratios

When it comes to profitability, Tyson Foods has maintained healthy margins despite fluctuations in input costs and market competition. Key profitability ratios such as gross profit margin, operating profit margin, and net profit margin have remained relatively stable, indicating the company's efficiency in generating profits from its operations.

Liquidity Ratios

In terms of liquidity, Tyson Foods has managed its assets effectively to meet short-term obligations. Ratios like current ratio and quick ratio reflect the company's ability to cover its current liabilities with its current assets, ensuring financial stability and operational continuity.

Solvency Ratios

Tyson Foods' solvency ratios, including debt-to-equity ratio and interest coverage ratio, demonstrate the company's financial health and ability to meet long-term debt obligations. Despite taking on debt for strategic investments and acquisitions, Tyson Foods has maintained a solid solvency position, reassuring investors about its long-term sustainability.Overall, Tyson Foods' financial performance in the past five years showcases its resilience and strategic management in navigating a dynamic market environment.

By carefully analyzing key financial metrics, investors can gain valuable insights into the company's financial strength and growth potential.

Market Trends and Competitive Landscape

In the ever-evolving food industry, market trends and the competitive landscape play a crucial role in determining the success of companies like Tyson Foods. Let's delve into the current scenario to understand how these factors are shaping the future of the industry.

Current Market Trends in the Food Industry

- The rise of plant-based alternatives: With an increasing focus on sustainability and health-conscious choices, plant-based meat alternatives have gained significant popularity in recent years. This trend has posed a challenge to traditional meat producers like Tyson Foods.

- Online food delivery services: The convenience of ordering food online has led to a surge in demand for ready-to-eat meals. Companies offering quick and easy meal solutions are thriving in this digital age.

- Health and wellness trends: Consumers are becoming more mindful of their food choices, preferring products that are organic, non-GMO, and free from artificial additives. This shift in consumer preferences is driving innovation in the food industry.

Key Competitors of Tyson Foods and Market Share

- JBS S.A.: As one of the largest meat processing companies globally, JBS S.A. is a significant competitor to Tyson Foods, holding a considerable market share in the industry.

- Cargill: Another major player in the food industry, Cargill competes with Tyson Foods across various product categories, including meat and poultry.

- Pilgrim's Pride Corporation: Specializing in poultry products, Pilgrim's Pride Corporation is a key competitor to Tyson Foods in the chicken market segment.

Recent Innovations and Changes in Consumer Preferences

- Focus on sustainable practices: Consumers are increasingly demanding transparency and sustainability in food production. Companies like Tyson Foods are responding by implementing eco-friendly initiatives and sourcing practices.

- Plant-based product lines: In response to the growing popularity of plant-based diets, Tyson Foods has introduced plant-based meat alternatives to cater to changing consumer preferences and expand its product offerings.

- Personalization and customization: With a growing emphasis on personalized nutrition, Tyson Foods is exploring ways to offer customizable food solutions to meet individual consumer needs and preferences.

Sustainability and Corporate Social Responsibility

When it comes to sustainability and corporate social responsibility, Tyson Foods has been actively working to improve its practices and initiatives in recent years. These efforts are crucial not only for the company's reputation but also for its long-term viability in an increasingly conscious market.

Sustainability Practices and Initiatives

- Tyson Foods has been focusing on reducing its environmental footprint by implementing water and energy conservation measures across its operations.

- The company has also made commitments to source sustainable ingredients and packaging materials, aiming to minimize waste and promote responsible sourcing practices.

- Furthermore, Tyson Foods has set targets to reduce greenhouse gas emissions and improve animal welfare standards in its supply chain.

Corporate Social Responsibility Efforts

- In terms of corporate social responsibility, Tyson Foods has been actively involved in community initiatives and disaster relief efforts, showcasing its commitment to giving back to society.

- The company has also invested in employee development programs and diversity initiatives to create a more inclusive and supportive work environment.

- Additionally, Tyson Foods has been transparent about its corporate governance practices, promoting accountability and ethical business conduct.

Impact on Long-Term Viability

By prioritizing sustainability and corporate social responsibility, Tyson Foods can enhance its brand reputation, attract socially conscious consumers, and build stronger relationships with stakeholders. These efforts can ultimately contribute to the company's long-term viability and competitiveness in the market.

Risk Assessment

When considering an investment in Tyson Foods, it is crucial to assess the potential risks that could impact the company's future performance. These risks can stem from various sources including geopolitical events, economic shifts, and industry-specific challenges. By evaluating these risks, investors can make more informed decisions and understand the strategies that Tyson Foods could implement to mitigate them.

Geopolitical Risks

- Trade disputes and tariffs affecting Tyson Foods' export markets.

- Political instability in key regions impacting supply chain operations.

- Regulatory changes in foreign markets affecting production and sales.

Economic Risks

- Fluctuations in commodity prices impacting input costs for Tyson Foods.

- Economic downturns leading to reduced consumer spending on meat products.

- Currency exchange rate volatility affecting international revenue streams.

Industry-specific Risks

- Health and safety concerns leading to product recalls and reputational damage.

- Increased competition from alternative protein sources impacting market share.

- Environmental regulations affecting production practices and sustainability efforts.

Last Recap

In conclusion, the discussion surrounding TSN Stock Analysis: Is Tyson Foods Still a Safe Investment in 2025? has provided valuable insights into the company's position in the market. With a focus on sustainability, market trends, and potential risks, investors can make informed decisions about the future of their investments in Tyson Foods.

Answers to Common Questions

Is Tyson Foods a reliable investment option for 2025?

Based on the analysis provided, Tyson Foods appears to be a safe investment choice for 2025, considering its market position and sustainability efforts.

What are the main products offered by Tyson Foods?

Tyson Foods offers a range of products including chicken, beef, pork, and prepared foods.

How does Tyson Foods compare to its competitors in terms of market share?

Tyson Foods holds a significant market share in the food industry, competing with companies like Cargill and JBS.