Exploring the concept of Loan Security Meaning in Banking: A Simple Explanation opens up a world of crucial financial knowledge. This introductory passage sets the stage for an insightful journey into the realm of loan security in the banking sector, offering a blend of informative content and engaging narrative.

The subsequent paragraph delves into the specifics of the topic, providing a comprehensive overview that is both enlightening and accessible.

Loan Security Meaning in Banking

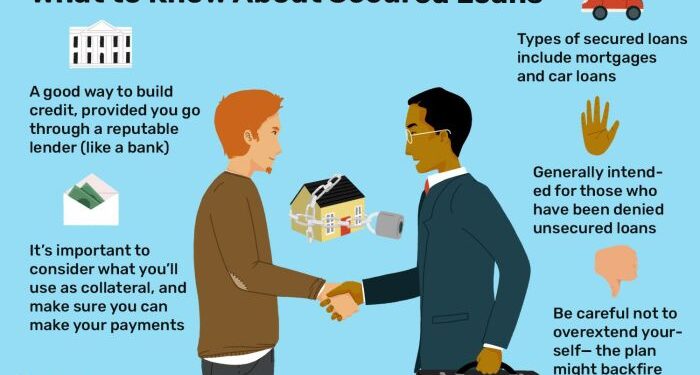

Loan security in banking refers to the assets or collateral that a borrower pledges to a lender in order to secure a loan. This collateral serves as a guarantee for the lender that if the borrower defaults on the loan, the lender can seize the collateral to recoup the outstanding amount.

Importance of Loan Security for Banks

Loan security is crucial for banks as it helps mitigate the risks associated with lending money. By having collateral in place, banks can reduce the chances of financial loss in case a borrower fails to repay the loan. This security provides a sense of assurance to the lender and helps maintain the stability of the banking system.

Common Types of Loan Security in Banking

- Real Estate: Properties such as homes, land, or commercial buildings can be used as collateral for loans.

- Automobiles: Vehicles like cars, trucks, or motorcycles can also serve as loan security.

- Inventory: Businesses can pledge their inventory as collateral to secure loans.

- Equipment: Machinery, tools, or other equipment can be used as security for business loans.

How Loan Security Helps Reduce Risks for Lenders

By requiring borrowers to provide collateral, lenders can assess the creditworthiness of the borrower and offer loans at lower interest rates. In the event of default, lenders have a tangible asset to recover the loan amount, reducing the overall risk associated with lending.

This practice also encourages responsible borrowing and helps maintain the stability of the banking industry.

Types of Loan Security

When it comes to securing a loan, various types of assets can be used as collateral to protect the lender's interests in case the borrower defaults on the loan. Let's explore the different types of loan security, the difference between secured and unsecured loans, the advantages and disadvantages of using different types of loan security, and how the value of loan security is determined.

Real Estate

Real estate, such as residential or commercial properties, is a common type of asset used as loan security. The property is pledged as collateral, and if the borrower fails to repay the loan, the lender can seize the property to recover their funds.

Automobiles

Vehicles like cars, trucks, or motorcycles can also be used as loan security. The lender may place a lien on the vehicle's title until the loan is fully repaid. If the borrower defaults, the lender can repossess the vehicle to cover the outstanding debt.

Investment Accounts

Investment accounts, such as stocks, bonds, or mutual funds, can serve as loan security. These assets are valued based on their market value, and the lender may liquidate them to recover the loan amount if necessary.

Jewelry and Valuables

High-value items like jewelry, artwork, or antiques can be used as collateral for a loan. The lender will assess the value of these items and hold them until the loan is repaid or liquidate them if the borrower defaults.

Secured vs. Unsecured Loans

Secured loans are backed by collateral, while unsecured loans do not require any security. Secured loans typically have lower interest rates and higher borrowing limits, but there is a risk of losing the collateral if the borrower fails to repay the loan.

Unsecured loans, on the other hand, are based solely on the borrower's creditworthiness and may have higher interest rates.

Advantages and Disadvantages

Using assets like real estate or investment accounts as loan security can provide borrowers with lower interest rates and higher loan amounts. However, there is a risk of losing these assets if the loan is not repaid. Unsecured loans offer more flexibility and do not require collateral, but they often come with higher interest rates and lower borrowing limits.

Value of Loan Security

The value of loan security is determined based on the market value of the assets used as collateral. Lenders may require an appraisal or assessment to determine the value of the assets and ensure that they are sufficient to cover the loan amount in case of default.

Legal Aspects of Loan Security

When it comes to loan security in banking, there are crucial legal aspects that both lenders and borrowers need to consider in order to protect their interests and ensure compliance with the law.Creating a legal agreement for loan security involves a detailed process that Artikels the terms and conditions of the loan, as well as the rights and obligations of both parties.

This agreement typically includes details about the collateral provided by the borrower to secure the loan, the repayment schedule, interest rates, and any other relevant provisions.In the unfortunate event that a borrower defaults on a loan with security, the legal framework provides lenders with various remedies to recover the outstanding amount.

These remedies may include seizing the collateral, selling the collateral to repay the debt, taking legal action against the borrower, or pursuing other avenues to recover the funds owed.

Examples of Legal Remedies for Lenders

- Seizure of Collateral: Lenders have the right to take possession of the collateral provided by the borrower in case of default. This collateral can then be sold to recover the outstanding amount.

- Foreclosure: In the case of real estate loans, lenders may have the right to foreclose on the property and sell it to repay the debt.

- Lawsuit: Lenders can take legal action against the borrower to enforce the terms of the loan agreement and recover the funds owed.

- Debt Collection Agencies: Lenders may also engage the services of debt collection agencies to recover the outstanding amount on their behalf.

Role of Collateral in Loan Security

Collateral plays a crucial role in loan security by providing a form of protection for lenders in case borrowers default on their loans. It acts as a guarantee for the repayment of the loan amount.

Definition and Significance of Collateral

Collateral refers to assets or property that a borrower pledges to a lender to secure a loan. The significance of collateral lies in its ability to mitigate the risk for lenders, as it provides them with an alternative source of repayment in case the borrower fails to fulfill their loan obligations.

- Collateral can include real estate, vehicles, investments, or valuable belongings.

- By offering collateral, borrowers demonstrate their commitment to repaying the loan, increasing their chances of approval.

- Lenders can seize and sell the collateral to recover their losses if the borrower defaults on the loan.

Evaluation of Collateral by Banks

Banks assess the value of collateral to determine its adequacy in covering the loan amount. The evaluation process involves appraising the market value of the collateral and considering factors like liquidity and depreciation.

- The higher the value of the collateral, the lower the risk for the lender, potentially resulting in more favorable loan terms for the borrower.

- Banks may require professional appraisals or inspections to verify the value and condition of the collateral.

- In some cases, banks may impose a loan-to-value ratio, limiting the amount of the loan based on the value of the collateral.

Impact of Collateral Value on Loan Terms

The value of collateral directly influences the terms of a loan, including the interest rate, loan amount, and repayment period. Higher-value collateral typically leads to more favorable loan terms, while lower-value collateral may result in stricter conditions.

- Valuable collateral can help borrowers secure lower interest rates and higher loan amounts.

- Collateral with stable value and high liquidity may lead to more flexible repayment options.

- If the value of the collateral depreciates significantly, banks may request additional collateral or adjust the loan terms accordingly.

Examples of Common Collateral

Common types of collateral used in loan agreements include:

- Real estate properties, such as homes or land

- Automobiles or other vehicles

- Investment accounts, stocks, or bonds

- Jewelry, art, or valuable collectibles

Closing Summary

Concluding our discussion on Loan Security Meaning in Banking: A Simple Explanation, we reflect on the key points covered and emphasize the importance of understanding this aspect of banking for both lenders and borrowers. The closing paragraph encapsulates the essence of loan security in a memorable and thought-provoking manner.

Quick FAQs

What is the significance of loan security for banks?

Loan security is essential for banks as it provides a form of protection against borrower defaults, ensuring a level of safety for the funds lent out.

How is the value of loan security determined?

The value of loan security is typically determined based on factors such as the type of asset offered, its market value, and the level of risk associated with it.

What legal remedies are available to lenders in case of borrower default?

Lenders can take legal action to seize the collateral provided by the borrower or pursue other avenues to recover the outstanding loan amount.