JEPI Stock Performance: Monthly Dividend Breakdown and Risk Factors sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

With a focus on JEPI stock overview, monthly dividend breakdown, stock performance analysis, and risk factors, this exploration delves deep into the intricacies of investing in JEPI and what it means for your financial portfolio.

JEPI Stock Overview

JEPI stock is a significant player in the financial market, offering investors an opportunity to benefit from monthly dividend payments. This stock is known for its consistent performance and attractive dividend yield, making it a popular choice among income-seeking investors.

Company Background

JEPI is managed by J.P. Morgan Asset Management, a reputable financial institution with a strong track record in managing investment products. The company's core operations focus on providing diversified exposure to preferred securities, allowing investors to access a unique asset class within their portfolio.

Monthly Dividend Breakdown

When it comes to the monthly dividend structure of JEPI stock, investors can expect a consistent and reliable income stream from their investment. JEPI follows a monthly dividend payment schedule, which can be attractive to income-oriented investors looking for regular cash flow.JEPI's dividend payout is competitive compared to industry standards, offering investors a decent yield while maintaining a steady payout frequency.

This can be appealing to investors seeking income stability and predictability in their investment portfolio.

Factors Influencing JEPI's Dividend Payments

- JEPI's underlying assets: The performance of the assets held by JEPI directly impacts the fund's ability to generate income for dividend payments.

- Market conditions: Fluctuations in the market can affect JEPI's dividend payments, as market volatility can impact the fund's income and overall performance.

- Interest rates: Changes in interest rates can also influence JEPI's dividend payments, as higher interest rates can lead to increased income generation for the fund.

- Management decisions: The decisions made by JEPI's management team regarding the fund's investments and income distribution can also impact dividend payments.

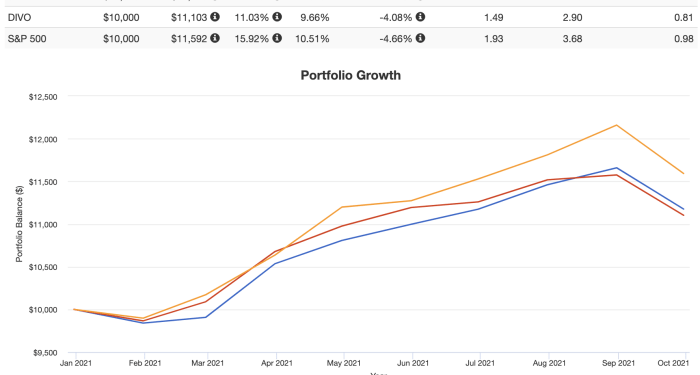

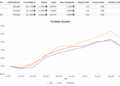

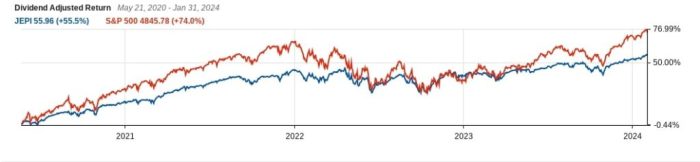

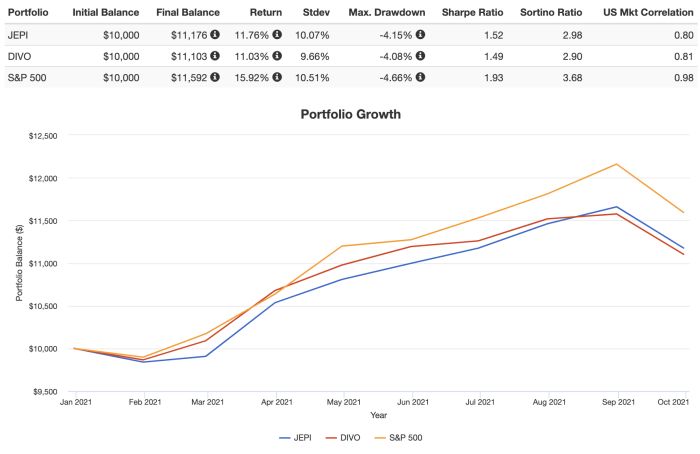

Stock Performance Analysis

When analyzing the historical stock performance of JEPI, it is important to consider how the stock has fared over time in terms of price movements and dividend payouts.

Comparison with Similar Dividend-Paying Stocks

- JEPI's performance can be compared with other dividend-paying stocks in the same sector or industry to gauge its relative strength.

- By looking at how JEPI stacks up against its peers, investors can better understand its position in the market and potential for growth.

- Examining the dividend yields, payout ratios, and overall financial health of similar stocks can provide valuable insights into JEPI's performance.

Identifying Trends and Patterns

- By analyzing JEPI's stock performance over different time periods, trends and patterns may emerge that could help predict future movements.

- Looking at factors such as price volatility, trading volume, and overall market conditions can reveal important insights into JEPI's performance.

- Identifying any recurring patterns or correlations can also assist investors in making more informed decisions regarding JEPI's stock.

Risk Factors

Investing in JEPI stock comes with certain key risk factors that investors should consider before making any decisions. These risk factors can impact the overall performance and stability of JEPI stock.

Market Volatility

Market volatility plays a significant role in affecting the value of JEPI stock. Fluctuations in the market can lead to sudden and drastic changes in stock prices, impacting investor returns. It is essential for investors to be aware of market conditions and how they can influence JEPI's risk profile.

Interest Rate Changes

Interest rate changes can also pose a risk to JEPI stock. As interest rates fluctuate, the value of dividend-paying stocks like JEPI may be affected. Investors should monitor interest rate trends and their potential impact on JEPI's dividend payouts.

Regulatory Changes

Regulatory changes at the local, national, or international level can introduce uncertainty and risk for JEPI stock. New regulations or policies may impact the company's operations, financial performance, and ultimately its stock price. Investors should stay informed about regulatory developments that could affect JEPI.

Company-Specific Risks

In addition to external factors, JEPI stock also faces company-specific risks. These may include management changes, competitive pressures, or shifts in consumer preferences. Understanding these internal risks is crucial for evaluating the overall risk-reward ratio of investing in JEPI stock.

Overall Risk-Reward Ratio

When considering the risk factors associated with JEPI stock, investors should weigh the potential risks against the expected rewards. Assessing the overall risk-reward ratio can help investors make informed decisions about whether JEPI stock aligns with their investment goals and risk tolerance.

Closing Notes

In conclusion, JEPI Stock Performance: Monthly Dividend Breakdown and Risk Factors sheds light on crucial aspects that investors need to consider. Whether you're a seasoned investor or just starting out, understanding these factors can pave the way for informed decision-making in the dynamic world of stock investments.

Detailed FAQs

What is the significance of JEPI stock in the financial market?

JEPI stock holds a unique position in the financial market due to its monthly dividend structure and historical performance.

How does external factors impact JEPI's risk profile?

External factors such as economic conditions, regulatory changes, and market trends can influence JEPI's risk profile, affecting its overall performance.

What are the key risk factors associated with investing in JEPI stock?

Key risk factors include market volatility, interest rate fluctuations, and company-specific risks that investors should carefully consider before investing in JEPI.