Delving into Business Debt Consolidation Loans: How to Lower Interest and Improve Cash Flow, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Business debt consolidation loans play a crucial role in helping businesses manage their finances effectively. By understanding the key strategies to lower interest rates and improve cash flow, businesses can navigate the complexities of debt consolidation with confidence.

Understanding Business Debt Consolidation Loans

Business debt consolidation loans are financial tools that allow businesses to combine multiple debts into a single loan with one monthly payment. The primary purpose of these loans is to simplify debt management and potentially lower interest rates, leading to improved cash flow and financial stability for the business.

Benefits of Business Debt Consolidation Loans

- Lower Interest Rates: By consolidating multiple debts into one loan, businesses may qualify for a lower interest rate, reducing the overall cost of borrowing.

- Simplified Repayment: Managing a single loan with a fixed monthly payment can make it easier for businesses to stay on top of their debt obligations.

- Improved Cash Flow: With potentially lower interest rates and a more manageable payment schedule, businesses can free up cash flow for other operational expenses or investments.

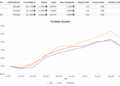

Typical Interest Rates

Business debt consolidation loan interest rates can vary depending on factors such as the business's creditworthiness, the lender's terms, and current market conditions. Generally, interest rates for these loans can range from 5% to 30%, with businesses that have stronger credit profiles typically qualifying for lower rates.

It's essential for businesses to shop around and compare offers from different lenders to secure the most favorable terms for their debt consolidation needs.

Factors Affecting Interest Rates on Business Debt Consolidation Loans

When it comes to business debt consolidation loans, the interest rates applied can vary based on several key factors. Understanding these factors is crucial for businesses looking to lower their interest rates and improve their cash flow.

Credit Score Impact

A business's credit score plays a significant role in determining the interest rates offered on debt consolidation loans. Lenders use the credit score as a measure of the borrower's creditworthiness and financial stability. A higher credit score indicates lower risk for the lender, which can result in a lower interest rate for the business.

On the other hand, a lower credit score may lead to higher interest rates or even difficulty in securing a loan.

Collateral for Lower Rates

Providing collateral can also impact the interest rates on business debt consolidation loans. Collateral serves as security for the lender, reducing the risk of lending money to the business. In return for this added security, lenders may offer lower interest rates on the loan.

Businesses that can offer valuable collateral, such as real estate or equipment, may be able to secure more favorable interest rates compared to those without collateral.

Strategies to Lower Interest on Business Debt Consolidation Loans

When it comes to lowering interest rates on business debt consolidation loans, there are several strategies that businesses can employ to negotiate better terms and improve their financial situation. One key aspect is refinancing existing debts to secure lower rates, along with maintaining a positive payment history to demonstrate reliability to lenders.

Refinancing Existing Business Debts

Refinancing existing business debts involves taking out a new loan to pay off existing debts, ideally at a lower interest rate. This can help businesses save money on interest payments over time, reducing the overall cost of borrowing. By consolidating multiple debts into a single loan with a lower interest rate, businesses can simplify their repayment process and potentially lower their monthly payments.

Maintaining a Positive Payment History

Maintaining a positive payment history is crucial for businesses looking to lower their interest rates on debt consolidation loans

By demonstrating reliability and financial stability, businesses can negotiate lower interest rates and improve their cash flow in the long run.

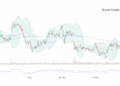

Improving Cash Flow Through Business Debt Consolidation Loans

When a business is struggling with multiple debts and high interest rates, it can severely impact its cash flow. However, by restructuring these debts through consolidation, businesses can significantly improve their cash flow.Reducing monthly payments through debt consolidation can free up more cash for daily operations, investments, and growth opportunities.

This extra cash can be crucial for businesses facing financial challenges or looking to expand their operations.

Impact of Reduced Monthly Payments on Cash Flow Management

- Lower monthly payments can help businesses better manage their cash flow by providing more predictable expenses each month.

- With more cash available, businesses can allocate funds towards working capital, inventory, marketing, or other essential areas.

- Improved cash flow management can also help businesses avoid late payments, penalties, and potential credit damage.

Examples of Reinvesting Saved Funds from Lower Interest Payments

- Businesses can use the saved funds to pay off other high-interest debts, further improving their financial position.

- Investing in new equipment or technology can increase efficiency and productivity, leading to potential cost savings in the long run.

- Expanding marketing efforts or launching new products/services can help attract more customers and increase revenue streams.

Ending Remarks

In conclusion, Business Debt Consolidation Loans: How to Lower Interest and Improve Cash Flow offers businesses a pathway to financial stability and growth. By implementing the discussed strategies and maintaining a positive payment history, businesses can optimize their cash flow and reduce financial stress.

Answers to Common Questions

How can businesses benefit from consolidating debts?

Consolidating debts allows businesses to combine multiple loans into a single, more manageable payment, often at a lower interest rate, simplifying financial management.

What factors influence the interest rates on business debt consolidation loans?

Key factors include the business's credit score, the amount of debt being consolidated, and the presence of collateral to secure the loan.

How can businesses negotiate lower interest rates on debt consolidation loans?

Businesses can negotiate by showcasing a positive payment history, exploring refinancing options, and leveraging their creditworthiness to secure better terms.

What impact does debt consolidation have on cash flow management?

Debt consolidation can improve cash flow by reducing monthly payments, freeing up capital for operational expenses or investment in growth opportunities.

How can businesses reinvest the saved funds from lower interest payments?

Businesses can reinvest saved funds by expanding operations, investing in new technologies, or paying off other high-interest debts to further improve financial health.