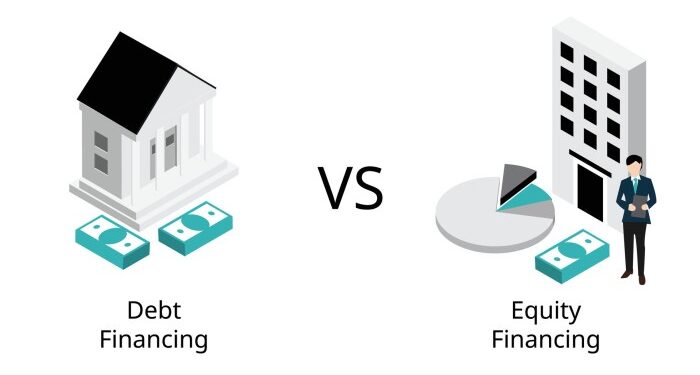

As Debt Financing vs Equity Financing: Which Is Better for Entrepreneurs? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this engaging discussion, we will delve into the realm of debt financing and equity financing, exploring the nuances and benefits each option offers to entrepreneurs.

Debt Financing vs Equity Financing

Debt financing and equity financing are two common methods for entrepreneurs to raise capital for their businesses. Each method has its own advantages and considerations that entrepreneurs need to evaluate based on their specific needs and goals.

Debt Financing

Debt financing involves borrowing money that must be repaid with interest over a certain period of time. This can come in the form of loans from financial institutions, lines of credit, or bonds. The main advantage of debt financing for entrepreneurs is that they do not have to give up ownership or control of their business.

Additionally, the interest paid on the debt is tax-deductible, which can help lower the overall cost of borrowing. However, too much debt can be risky, as it increases financial leverage and the potential for financial distress if the business struggles to make payments.

Equity Financing

Equity financing, on the other hand, involves selling a stake in the business to investors in exchange for capital. This can come in the form of angel investors, venture capitalists, or through crowdfunding platforms. The main advantage of equity financing is that entrepreneurs do not have to repay the funds invested.

Investors also bring valuable expertise and connections to the table, which can help the business grow and succeed. However, giving up ownership means sharing profits and decision-making power with investors, which can lead to conflicts of interest and loss of control.

Considerations for Entrepreneurs

When entrepreneurs are faced with the decision between debt and equity financing, there are several key factors they need to consider to make the best choice for their business.

Impact of Debt Financing on Financial Risk

Debt financing can be a double-edged sword for entrepreneurs. On one hand, taking on debt allows entrepreneurs to maintain ownership and control of their business. However, it also increases the financial risk. If the business is unable to generate enough revenue to cover the debt payments, it can lead to financial distress and potential bankruptcy.

Entrepreneurs need to carefully assess their ability to make timely debt payments and the impact it will have on their overall financial health.

Impact of Equity Financing on Ownership and Control

Equity financing involves selling a portion of the business to investors in exchange for capital. While this can provide the necessary funds without the burden of debt repayments, it also means giving up a portion of ownership and control. Entrepreneurs need to consider how much control they are willing to relinquish and whether they are comfortable sharing decision-making power with investors.

It's essential to strike a balance between securing funding and maintaining autonomy over the direction of the business.

Types of Debt Financing

When it comes to debt financing, entrepreneurs have various options to consider. Here are some of the different types of debt financing available to entrepreneurs:

1. Bank Loans

Bank loans are one of the most common forms of debt financing for entrepreneurs. These loans are typically offered by banks and come with fixed interest rates and repayment schedules. Entrepreneurs can use bank loans to fund business operations, purchase equipment, or expand their business.

2. Lines of Credit

Lines of credit are another type of debt financing that provides entrepreneurs with access to a certain amount of funds that they can borrow as needed. This type of financing is flexible, allowing entrepreneurs to borrow and repay funds multiple times within a set limit.

3. Asset-Based Financing

Asset-based financing involves using a company's assets, such as accounts receivable, inventory, or equipment, as collateral for a loan. This type of financing is beneficial for businesses that have valuable assets but may not qualify for traditional bank loans.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms connect individual investors with borrowers, including entrepreneurs. This type of debt financing often offers competitive interest rates and flexible terms, making it an attractive option for entrepreneurs looking for funding outside of traditional financial institutions.

Process of Obtaining Debt Financing

Obtaining debt financing typically involves the following steps:

- Researching and comparing different lenders and loan options.

- Preparing a detailed business plan and financial statements to present to potential lenders.

- Submitting a loan application and providing any required documentation.

- Going through the underwriting process, where the lender evaluates the borrower's creditworthiness and business viability.

- Receiving approval and agreeing to the terms of the loan before receiving the funds.

Requirements for Obtaining Debt Financing

The requirements for obtaining debt financing can vary depending on the type of loan and the lender. Some common requirements may include a solid credit history, a well-developed business plan, collateral, and a demonstrated ability to repay the loan.

Examples of Successful Businesses Utilizing Debt Financing

Many successful businesses have utilized debt financing to fuel their growth and expansion. For example, Airbnb secured significant debt financing to help fund its global expansion, while Warby Parker used debt financing to support its online eyewear business. These businesses demonstrate how debt financing can be a valuable tool for entrepreneurs looking to scale their ventures.

Types of Equity Financing

Equity financing offers entrepreneurs the opportunity to raise capital by selling ownership stakes in their business. Here are some common types of equity financing available to entrepreneurs:

Angel Investors

Angel investors are individuals who invest their personal funds in early-stage businesses in exchange for equity ownership. These investors often provide not only capital but also valuable expertise and connections to help the business grow.

Venture Capital

Venture capital firms are investment companies that provide funding to startups and small businesses with high growth potential. In exchange for their investment, venture capitalists typically take equity in the company and play an active role in guiding its growth and development.

Private Equity

Private equity firms invest in established businesses with the goal of growing them and eventually selling for a profit. These firms typically acquire a significant ownership stake in the business and work closely with management to increase its value.

Equity Crowdfunding

Equity crowdfunding platforms allow entrepreneurs to raise capital from a large number of individual investors in exchange for equity in the business. This form of financing has gained popularity in recent years as a way to access funding from a diverse pool of investors.

Strategic Partnerships

Entrepreneurs can also seek equity financing through strategic partnerships with corporations or other businesses that can provide not only capital but also access to resources, distribution channels, and expertise to help the business grow.Each type of equity financing has its own unique characteristics and considerations, so entrepreneurs must carefully evaluate their options and choose the best fit for their business goals and growth plans.

End of Discussion

In conclusion, the decision between debt financing and equity financing remains a critical one for entrepreneurs, with each avenue presenting unique advantages and considerations. By understanding the implications of these financial strategies, entrepreneurs can make informed choices that align with their business goals and growth plans.

Quick FAQs

What are the key differences between debt financing and equity financing?

Debt financing involves borrowing money that needs to be repaid with interest, while equity financing involves selling a stake in the company in exchange for funds.

How does debt financing impact an entrepreneur's financial risk?

Debt financing increases financial risk as the entrepreneur is obligated to repay the borrowed amount regardless of the business's performance.

What factors should entrepreneurs consider when choosing between debt and equity financing?

Entrepreneurs should consider factors like control, ownership dilution, interest payments, and growth plans when deciding between debt and equity financing.