Kicking off with Financial Issues in Marriage: 7 Money Habits That Destroy Relationships, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

The content of the second paragraph that provides descriptive and clear information about the topic

Common Money Habits in Marriages

Money habits can play a significant role in the success or failure of a marriage. Here are seven money habits that can potentially harm relationships:

Overspending

Overspending refers to spending more money than what is available or beyond one's means. This habit can lead to financial strain, arguments, and stress in a marriage. It can also result in debt accumulation, making it difficult to achieve financial goals together.

Secretive Spending

Secretive spending involves hiding purchases or financial decisions from your partner. This lack of transparency can erode trust and lead to feelings of betrayal. It creates a communication barrier and can result in conflicts over money management.

Financial Infidelity

Financial infidelity occurs when one partner hides financial information, such as debts, accounts, or income, from the other. This breach of trust can have long-lasting effects on the relationship, leading to feelings of betrayal, resentment, and insecurity.

Not Setting Financial Goals

A lack of clear financial goals can make it challenging for couples to work together towards a common financial future. Without shared objectives, it's easy to drift apart in terms of spending, saving, and investing, causing friction in the relationship.

Ignoring Financial Responsibilities

Ignoring financial responsibilities, such as paying bills on time or managing joint accounts, can create tension and arguments in a marriage. It can also lead to financial instability and jeopardize the couple's financial well-being.

Competitive Spending

Competitive spending refers to trying to outspend or keep up with others in terms of material possessions or lifestyle choices. This habit can strain a couple's finances, create a sense of inadequacy, and fuel feelings of jealousy or resentment.

Not Communicating About Money

A lack of open communication about money matters can lead to misunderstandings, conflicts, and financial surprises. It's essential for couples to discuss their financial values, priorities, and concerns regularly to ensure alignment and avoid financial disagreements.

Lack of Financial Transparency

Financial transparency is crucial in a marriage as it promotes trust, collaboration, and a sense of shared responsibility when it comes to managing money. When couples are open and honest about their financial situation, they can make informed decisions together and work towards common financial goals.

Examples of Issues Caused by Lack of Financial Transparency

- Secretly accumulating debt without informing your partner can lead to financial strain and trust issues.

- Hidden accounts or undisclosed income can create feelings of betrayal and dishonesty within the relationship.

- Not discussing financial goals and priorities can result in misalignment and conflicts over how money should be spent.

Strategies to Improve Financial Communication

- Have regular money conversations to discuss income, expenses, savings, and financial goals openly.

- Be honest about your financial habits, including spending patterns, debts, and any financial concerns you may have.

- Create a budget together to track expenses and allocate funds towards shared goals.

- Consider seeking the help of a financial counselor or advisor to facilitate discussions and provide guidance on managing finances as a couple.

Different Approaches to Money Management

When it comes to managing finances in a marriage, partners often bring their unique money management styles to the table. These different approaches can sometimes lead to conflicts if not addressed effectively. Understanding and reconciling these differences is crucial for a healthy financial relationship.

Comparing and Contrasting Money Management Styles

- One partner may be a spender, while the other is a saver. This can create tension as one person wants to enjoy the present while the other is focused on saving for the future.

- Some couples prefer a hands-off approach, giving each individual autonomy over their finances, while others believe in joint accounts and shared financial responsibilities.

- There are also differences in risk tolerance when it comes to investments, with one partner being more conservative and the other more willing to take risks.

Challenges of Conflicting Money Management Approaches

- Conflicts can arise when one partner feels restricted by the other's spending habits or lack of financial discipline.

- Differences in financial goals and priorities can lead to disagreements on how money should be allocated and spent.

- Lack of communication and transparency about financial decisions can breed mistrust and resentment in the relationship.

Tips for Finding a Middle Ground

- Have open and honest conversations about money, discussing each other's financial values, goals, and concerns.

- Set joint financial goals that align with both partners' priorities and create a budget together to achieve them.

- Consider a compromise where each partner has some autonomy over a portion of the finances while also contributing to shared expenses and savings goals.

- Seek professional help from a financial advisor or counselor to mediate discussions and provide guidance on managing finances as a team.

Unequal Financial Contributions

Unequal financial contributions in a marriage can often lead to feelings of resentment and strain on the relationship. It is essential to address these disparities in a constructive manner to maintain a healthy financial dynamic.

Impact of Unequal Financial Contributions

When one partner contributes significantly more financially than the other, it can create a power imbalance and feelings of inadequacy. This can lead to arguments, lack of trust, and overall dissatisfaction in the relationship.

Addressing Resentment from Financial Disparities

- Open Communication: Discuss openly and honestly about each other's financial expectations, limitations, and contributions to avoid misunderstandings.

- Seeking Counseling: If feelings of resentment persist, seeking the help of a financial counselor or therapist can provide a neutral space for both partners to express their concerns.

- Understanding Each Other's Perspective: Empathy and understanding towards each other's financial situation can help alleviate any negative emotions that may arise.

Creating a Fair Financial Contribution System

- Equal Percentage Contribution: Instead of equal amounts, consider contributing a percentage of each partner's income towards shared expenses to ensure fairness.

- Joint Budgeting: Collaboratively create a budget that takes into account both partner's financial capabilities and goals to ensure transparency and equality in financial decisions.

- Establishing Shared Financial Goals: Setting common financial goals and working towards them together can help strengthen the bond and promote a sense of shared responsibility.

Hidden Debts and Financial Infidelity

Financial infidelity occurs when one partner in a marriage hides financial information or engages in deceitful financial behavior, leading to a breach of trust in the relationship. This can have serious consequences and negatively impact the overall health of the marriage.

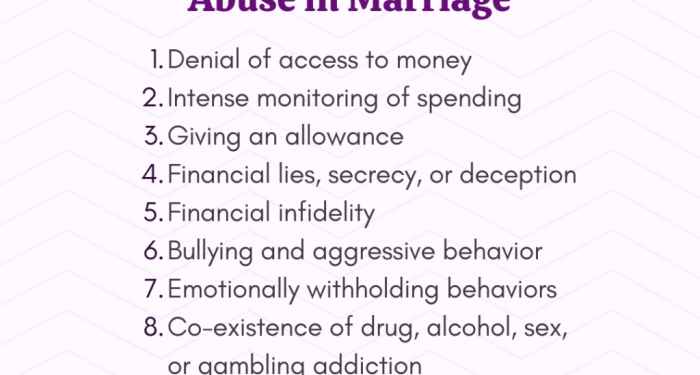

Signs of Hidden Debts or Financial Infidelity

- Unexplained withdrawals or charges on bank statements.

- Secretive behavior regarding financial matters.

- Reluctance to discuss money or avoidance of financial conversations.

- Sudden changes in spending habits or lifestyle without a reasonable explanation.

Rebuilding Trust After Financial Infidelity

- Open and honest communication about financial matters moving forward.

- Seeking professional help or counseling to address underlying issues.

- Establishing clear financial boundaries and expectations within the relationship.

- Working together to create a financial plan and budget to rebuild trust and financial stability.

Failure to Set Financial Goals Together

Setting financial goals as a couple is crucial for building a strong and stable relationship. It allows both partners to align their priorities, work towards a common objective, and establish a sense of unity and teamwork when it comes to finances.

Importance of Setting Financial Goals

When couples set financial goals together, they are able to create a roadmap for their financial future. This helps in making joint decisions about spending, saving, and investing, leading to better financial stability and security. It also promotes open communication and trust between partners, as they work towards a shared vision.

Examples of Common Financial Goals

- Buying a home

- Saving for retirement

- Creating an emergency fund

- Paying off debt

- Planning for children's education

Benefits of Setting Financial Goals Together

By setting financial goals together, couples can strengthen their relationship in several ways. It fosters collaboration and compromise, as both partners have a say in determining their financial priorities. It also promotes accountability and encourages regular discussions about money matters, leading to a deeper understanding of each other's values and aspirations.

Lack of Emergency Fund and Financial Planning

Having an emergency fund is crucial for any marriage as it provides a safety net during unexpected financial crises. Without this fund, couples may find themselves struggling to cope with emergencies, leading to stress, arguments, and even potential financial ruin.

Significance of Having an Emergency Fund

- Emergency funds help cover unexpected expenses like medical emergencies, car repairs, or job loss without resorting to high-interest debt.

- Having a financial cushion in place reduces stress and allows couples to focus on supporting each other during difficult times.

- It provides a sense of security and peace of mind, knowing that there is a financial buffer in case of emergencies.

Impact of Inadequate Financial Planning on a Relationship During Crises

- Without proper financial planning, couples may struggle to prioritize expenses during emergencies, leading to disagreements and strained relationships.

- Inadequate financial planning can result in increased debt, missed bill payments, and overall financial instability, causing stress and tension in the marriage.

- Couples may feel overwhelmed and helpless when facing unexpected financial challenges without a solid plan in place.

Steps to Establish an Emergency Fund and Improve Financial Planning as a Couple

- Calculate your monthly expenses and set a realistic savings goal for your emergency fund, aiming for at least 3-6 months' worth of living expenses.

- Automate your contributions to the emergency fund by setting up regular transfers from your checking account to a separate savings account.

- Track your spending and identify areas where you can cut back to increase your savings for emergencies.

- Create a budget together and review it regularly to ensure you are on track to achieve your financial goals.

- Consider seeking the advice of a financial planner to help you establish a comprehensive financial plan that includes savings goals, investments, and debt management strategies.

Final Thoughts

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Resource

What are some common money habits that can harm relationships?

Some common money habits include overspending, avoiding financial discussions, and hiding debts.

How can lack of financial transparency impact a marriage?

Lack of financial transparency can lead to distrust, arguments, and financial surprises.

What are signs of financial infidelity in a marriage?

Signs of financial infidelity include secretive behavior with money, unexplained expenses, and hidden accounts.

Why is it important for couples to set financial goals together?

Setting financial goals together helps couples align their priorities, work towards shared objectives, and improve communication.

How can partners address feelings of resentment due to unequal financial contributions?

Partners can address resentment by having open discussions, creating a fair financial system, and understanding each other's perspectives.