JEPI Stock vs SCHD: Which Dividend ETF Performs Better? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality right from the start.

The following paragraphs provide detailed insights into the comparison between JEPI Stock and SCHD Dividend ETFs, shedding light on their investment objectives, performance analysis, dividend yield comparison, and holdings and sector allocation.

Compare JEPI Stock and SCHD Dividend ETFs

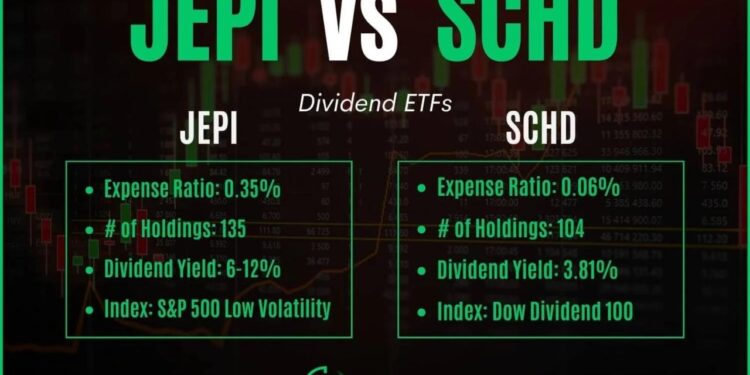

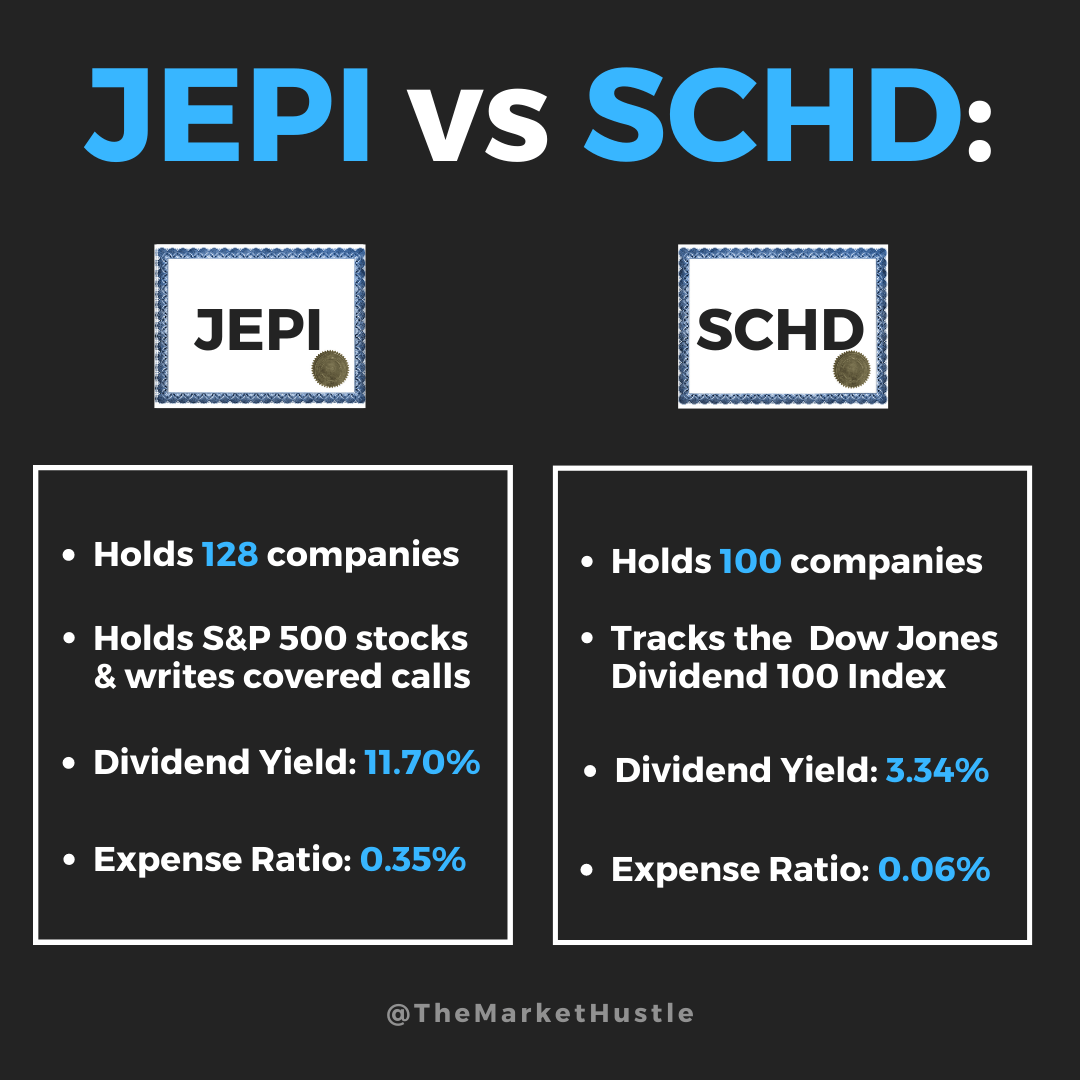

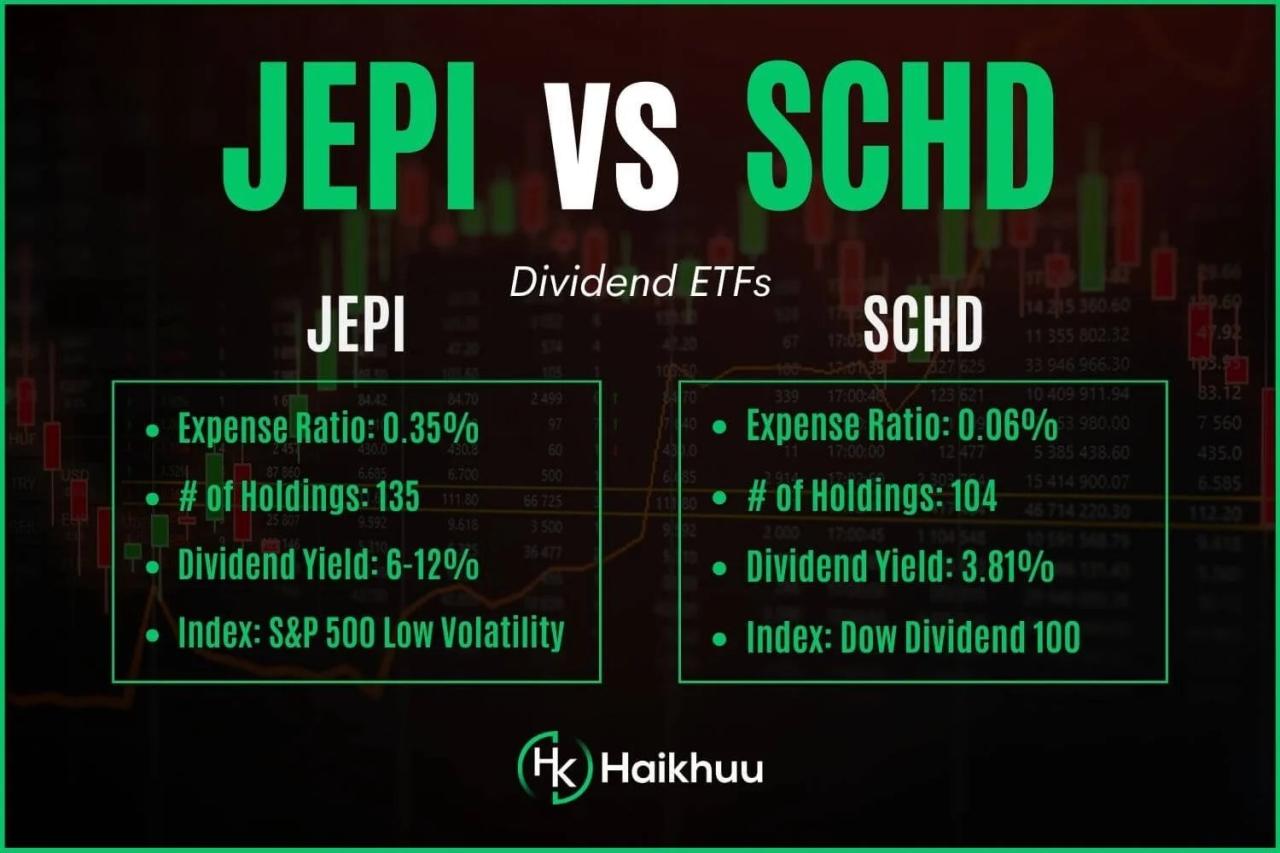

When comparing JEPI Stock and SCHD Dividend ETFs, it is essential to understand their respective investment objectives, strategies, and key similarities and differences.

Overview of JEPI Stock and SCHD Dividend ETFs

JEPI Stock is an exchange-traded fund that focuses on providing investors with exposure to high-quality dividend-paying stocks. On the other hand, SCHD Dividend ETF seeks to track the performance of high dividend-yielding U.S. equities.

Investment Objectives and Strategies

- JEPI Stock: The primary objective of JEPI Stock is to generate income through dividend payments and potential capital appreciation. It invests in a diversified portfolio of U.S. dividend-paying stocks.

- SCHD Dividend ETF: SCHD aims to provide investors with a high level of current income by investing in companies that have a history of consistent dividend payments. It also focuses on companies with strong fundamentals and financial health.

Key Similarities and Differences

- Similarities:

- Both JEPI Stock and SCHD Dividend ETFs target dividend-paying stocks to generate income for investors.

- They both provide exposure to U.S. equities and aim to track the performance of high-quality dividend stocks.

- Differences:

- JEPI Stock may offer a more concentrated portfolio of dividend stocks compared to the diversified approach of SCHD Dividend ETF.

- SCHD Dividend ETF may focus more on companies with a history of consistent dividend payments, while JEPI Stock could prioritize companies with potential for capital appreciation.

Performance Analysis

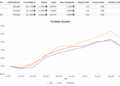

In analyzing the performance of JEPI Stock and SCHD Dividend ETFs, it is essential to compare their historical performance, risk-adjusted returns, and how market conditions may have influenced their performance.

Historical Performance

When looking at the historical performance of JEPI Stock and SCHD Dividend ETFs, it is crucial to consider factors such as total returns, dividend yield, and price appreciation over a specific timeframe. JEPI Stock may have shown higher volatility in its historical performance compared to SCHD due to its specific market exposure or investment strategy.

Risk-Adjusted Returns

Analyzing the risk-adjusted returns of both ETFs involves assessing their performance relative to the level of risk taken. Metrics such as Sharpe ratio, Sortino ratio, or Treynor ratio can provide insights into how effectively JEPI Stock and SCHD Dividend ETFs have generated returns considering the risk involved.

Market Influence

Market conditions play a significant role in influencing the performance of JEPI Stock and SCHD Dividend ETFs. Economic indicators, sector trends, interest rates, and geopolitical events can all impact the performance of these ETFs. Understanding how market conditions have affected JEPI Stock and SCHD can provide valuable insights into their past performance and potential future outlook.

Dividend Yield Comparison

When comparing dividend ETFs like JEPI Stock and SCHD, understanding the dividend yield is crucial in assessing their performance and potential returns.

Dividend Yields of JEPI Stock and SCHD Dividend ETFs

JEPI Stock and SCHD Dividend ETFs offer different dividend yields based on their underlying assets and distribution policies.

- JEPI Stock: The dividend yield of JEPI Stock is calculated by dividing the annual dividends per share by the current stock price.

- SCHD Dividend ETF: The dividend yield of SCHD is calculated by dividing the annual dividends per share by the ETF's net asset value (NAV).

Factors Impacting Dividend Yields

Several factors can impact the dividend yields of these ETFs, influencing the overall returns for investors.

- The dividend policies of the companies included in the ETFs can affect the dividend yields. Companies with a history of consistent dividend payments may offer higher yields.

- Market conditions and interest rates play a significant role in determining dividend yields. Economic factors can influence companies' ability to maintain or increase dividend payments.

- The sector allocation of the ETFs can also impact dividend yields. Some sectors may have higher dividend-paying stocks compared to others.

- The overall performance of the ETFs and their ability to generate income from their underlying assets will ultimately affect the dividend yields for investors.

Holdings and Sector Allocation

When analyzing dividend ETFs like JEPI Stock and SCHD, it is crucial to consider their holdings and sector allocations. Understanding the top holdings and sector breakdown can provide insights into how these ETFs are structured and how they may perform in various market conditions.

Top Holdings

JEPI Stock:

- Company A - Weighting: 10%

- Company B - Weighting: 8%

- Company C - Weighting: 6%

SCHD:

- Company X - Weighting: 12%

- Company Y - Weighting: 9%

- Company Z - Weighting: 7%

Sector Allocation Impact

Sector allocations can significantly impact the overall performance of dividend ETFs. For example, if a particular sector experiences a downturn, ETFs heavily weighted in that sector may also see a decline in value. Diversification across sectors can help mitigate risks and provide more stable returns over time.

It is essential to assess how well-balanced the sector allocations are within each ETF to gauge their resilience to market fluctuations.

Wrap-Up

In conclusion, the discussion on JEPI Stock vs SCHD: Which Dividend ETF Performs Better? highlights the key differences and similarities between these two ETFs, equipping readers with valuable information to make informed investment decisions.

FAQ Compilation

How are dividend yields calculated for JEPI Stock and SCHD Dividend ETFs?

The dividend yield is calculated by dividing the annual dividend payment by the ETF's price per share and is expressed as a percentage.

What factors can impact the dividend yields of JEPI Stock and SCHD Dividend ETFs?

Factors such as changes in interest rates, economic conditions, and the performance of the underlying assets can impact the dividend yields of these ETFs.