Delving into Mezzanine Debt Financing: Ideal for Expanding Middle-Market Companies, this introduction immerses readers in a unique and compelling narrative, providing insights into the world of financing for middle-market companies. Exploring the nuances of mezzanine debt financing and its relevance in facilitating growth, this piece aims to shed light on a lesser-known yet valuable financial tool.

As we delve deeper into the intricacies of mezzanine debt financing, we will uncover the key considerations, benefits, and potential risks associated with this form of financing.

Introduction to Mezzanine Debt Financing

Mezzanine debt financing is a form of hybrid financing that combines elements of debt and equity. It is typically used by middle-market companies looking to expand their operations but may not have access to traditional bank loans or do not want to dilute existing ownership.

Examples of When Middle-Market Companies Might Consider Mezzanine Debt Financing

- When a company wants to fund a significant expansion project but lacks the necessary collateral for a traditional bank loan.

- During a management buyout when the current owners want to sell a portion of the business to key employees without reducing their ownership stake.

- For financing a merger or acquisition where the company needs additional capital beyond what traditional lenders are willing to provide.

Benefits and Risks Associated with Using Mezzanine Debt Financing for Expansion

Mezzanine debt financing offers several benefits, such as:

- Flexibility in repayment terms compared to traditional bank loans.

- Allows companies to leverage their existing assets and cash flow without giving up ownership stakes.

- Higher loan amounts than what may be available through traditional lenders.

However, there are risks involved, including:

- Higher interest rates compared to traditional loans due to the increased risk for lenders.

- Potential dilution of ownership if the company is unable to repay the debt on time.

- Mezzanine lenders may have more control over the company's operations compared to traditional lenders.

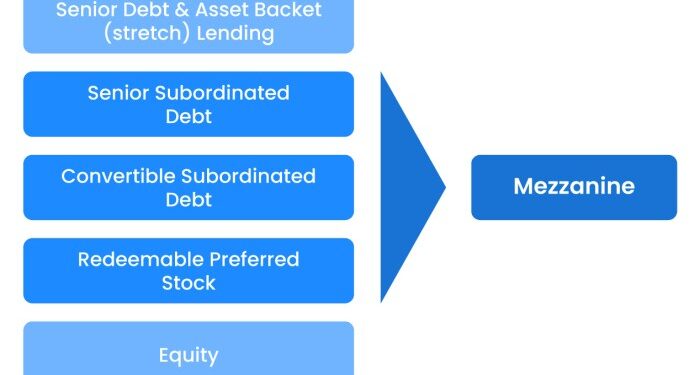

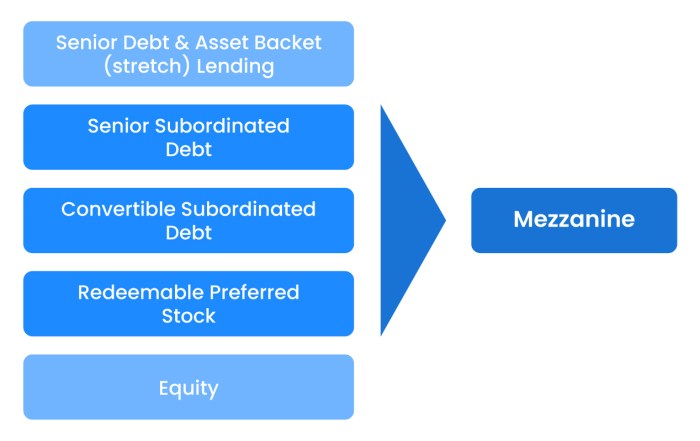

Understanding the Structure of Mezzanine Debt

Mezzanine debt financing is a hybrid form of financing that sits between senior debt and equity in a company's capital structure. It is typically used by middle-market companies looking to expand, finance acquisitions, or restructure their balance sheets.

Typical Terms and Structure of Mezzanine Debt

Mezzanine debt usually has a higher interest rate than senior debt due to its subordinated position. It may also include equity kickers such as warrants or options that allow the lender to participate in the company's future success. The repayment terms are often flexible and can include a combination of cash interest, payment-in-kind (PIK) interest, and a balloon payment at maturity.

Comparison with Other Types of Financing

Compared to traditional senior debt, mezzanine debt offers more flexibility in terms of repayment schedules and collateral requirements. However, it is more expensive due to the higher interest rates and equity participation. On the other hand, equity financing gives the investor ownership and voting rights in the company, which mezzanine debt does not.

Repayment Terms of Mezzanine Debt

Repayment terms of mezzanine debt can be structured in various ways. For example, a common structure is to have a cash interest component paid regularly, with the PIK interest added to the principal amount. The balloon payment is then due at the end of the term, which can range from 5 to 7 years.

This structure allows the company to conserve cash flow in the initial years and pay down the debt as the business grows.

Eligibility and Criteria for Middle-Market Companies

When it comes to qualifying for mezzanine debt financing, middle-market companies need to meet specific criteria to be considered eligible. These criteria typically revolve around the company's growth stage, financial performance, and overall creditworthiness.

Key Criteria for Qualification

- Revenue and EBITDA: Lenders often look for middle-market companies with a track record of consistent revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA). This demonstrates the company's ability to generate cash flow to support debt obligations.

- Growth Potential: Companies seeking mezzanine debt financing should have a clear growth strategy in place. Lenders are more inclined to provide funding to businesses with strong growth potential in their industry.

- Management Team: The expertise and experience of the company's management team are crucial factors in the lender's assessment. A capable management team inspires confidence in the company's ability to execute its growth plans successfully.

- Collateral: While mezzanine debt is typically unsecured, lenders may still consider the availability of collateral as a secondary source of repayment in case of default.

Impact of Growth Stage and Financial Performance

Middle-market companies at different growth stages may have varying eligibility for mezzanine debt financing. Early-stage companies with limited operating history may find it challenging to secure mezzanine financing due to the higher risk involved. On the other hand, mature companies with a proven track record of profitability are more likely to meet the criteria set by lenders.

Lender Assessment for Mezzanine Debt Financing

- Debt-to-EBITDA Ratio: Lenders often evaluate a company's debt-to-EBITDA ratio to assess its leverage and repayment capacity. A lower ratio indicates a healthier financial position and enhances the company's eligibility for mezzanine financing.

- Cash Flow Analysis: Lenders analyze the company's cash flow projections to ensure that it can meet its debt obligations comfortably. Positive cash flow projections strengthen the company's case for mezzanine debt financing.

- Industry Outlook: The lender considers the industry in which the company operates and its growth prospects. Companies in stable or growing industries are more attractive to lenders seeking to provide mezzanine financing.

- Exit Strategy: Lenders also look for a clear exit strategy Artikeld by the company, demonstrating how the debt will be repaid within the agreed-upon timeframe. A well-defined exit strategy adds credibility to the company's funding request.

Pros and Cons of Mezzanine Debt Financing

When considering mezzanine debt financing for expanding middle-market companies, it is essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Mezzanine Debt Financing

- Flexible Terms: Mezzanine debt typically offers more flexibility in terms compared to traditional bank loans, allowing companies to tailor the repayment structure to their cash flow.

- No Dilution of Ownership: Unlike equity financing, mezzanine debt does not require giving up ownership stakes in the company, allowing existing owners to retain control.

- Higher Loan Amounts: Middle-market companies can access larger loan amounts through mezzanine financing, enabling them to fund substantial growth initiatives.

- Tax Deductibility: The interest payments on mezzanine debt are often tax-deductible, providing a potential tax advantage for the company.

Drawbacks of Mezzanine Debt Financing

- High Cost: Mezzanine debt comes with higher interest rates and fees compared to traditional bank loans, making it a more expensive form of financing.

- Risk of Default: Since mezzanine debt is considered a higher-risk investment, companies that fail to meet repayment obligations could face severe consequences, including potential bankruptcy.

- Limited Collateral: Mezzanine lenders may have limited collateral to secure the debt, putting more pressure on the company to meet repayment terms.

- Restrictions on Operations: Some mezzanine debt agreements may include covenants that restrict the company's operations or financial decisions, limiting flexibility.

Real-World Examples

Successful Case: XYZ Company used mezzanine debt financing to fund a strategic acquisition, expanding its market presence and increasing revenue significantly without relinquishing ownership control.

Unsuccessful Case: ABC Company struggled to meet the high-interest payments associated with mezzanine debt, leading to financial distress and ultimately defaulting on the loan, resulting in a loss of control and possible bankruptcy.

Last Recap

In conclusion, Mezzanine Debt Financing emerges as an ideal choice for expanding middle-market companies seeking to fuel their growth. By offering a flexible and tailored approach to financing, it opens up new avenues for businesses looking to take the next step in their expansion journey.

Detailed FAQs

What are the typical repayment terms for mezzanine debt financing?

Repayment terms for mezzanine debt financing can vary but often include a combination of interest payments and a balloon payment at the end of the loan term.

How does mezzanine debt financing differ from traditional bank loans?

Unlike traditional bank loans, mezzanine debt financing typically involves a higher interest rate and allows lenders to convert their debt into equity if the borrower defaults.

What are some common eligibility criteria for middle-market companies seeking mezzanine debt financing?

Middle-market companies usually need to demonstrate a strong track record of performance, stable cash flow, and a solid growth strategy to qualify for mezzanine debt financing.